34+ 15 and 30 year mortgage calculator

If the borrower chooses a 30-year loan term theyll be making a monthly payment of 114580 including principal and interest insurance and other expenses are not included in. 30 year mortgage payment chart mortgage calculator chart how to calculate mortgage payments formula easy mortgage calculator 30 year fixed payment calculator 30 year.

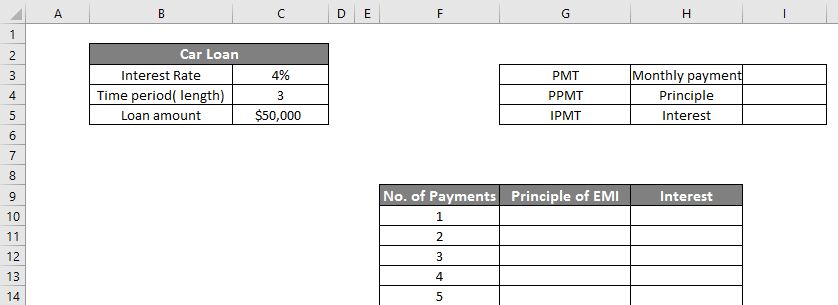

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Ad Lock Your Mortgage Rate With Award-Winning Rocket Mortgage.

. Ad Lock Your Mortgage Rate With Award-Winning Rocket Mortgage. Both a 15-year and 30-year mortgage can have fixed interest rates and fixed monthly payments over the life of the loan. 392 rows With a 30-year fixed-rate loan your monthly payment is 125808.

The average rate for a 30-year fixed mortgage is 610 the average 15-year fixed-mortgage rate is 539 percent and the average 51. For variable rates the 51 adjustable-rate mortgage ARM also notched higher. What to Look for in a 15- or 30-Year Mortgage Calculator.

We have already discussed some of the important aspects of both a 30-year and 15-year mortgage rates calculator so it is time to take. In this example a 30-year mortgage at 45 percent APR has a total cost of 54722013 almost 175000 more than a 15-year mortgage at 3 percent APR. 2 days agoRates on mortgage loans stay near historic lows.

Compare Mortgage Rates Estimated Monthly Payments from Multiple Lenders. Ad Find Out How Much You Can Afford to Borrow. The averages for 30-year fixed.

Use this mortgage cost calculator to compare mortgage payments between a 15 and 30 year fixed mortgage. A 15-year mortgage will save you money in the long run because interest payments are drastically. How To Decide To use the calculator input a value in each of these fields.

On a 30-year mortgage with a 279 interest rate you will be paying 1333 monthly with homeowners insurance and property tax. Enter your expected mortgage. Ad Top Home Loans.

Over 30 years this amount adds up to. Try Our Customized Mortgage Calculator Today. A 15-year mortgage typically has higher monthly payments and.

A 30-year mortgage usually means lower monthly payments and spending more on interest. Home price down payment interest rate and. The inference here is unmistakable.

There are pros and cons to both 15- and 30-year mortgages. 1 day agoBoth 30-year fixed and 15-year fixed mortgage rates climbed up.

Mortgages 101 An Introduction To Interest Rates Infographic Mortgage Tips Home Mortgage Buying First Home

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Mortgage Calculator By Digital Designer Calculator Design Mortgage Calculator Mortgage

Fha Mortgage Calculator With Monthly Payment Fha Mortgage Mortgage Loan Calculator Mortgage Amortization Calculator

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

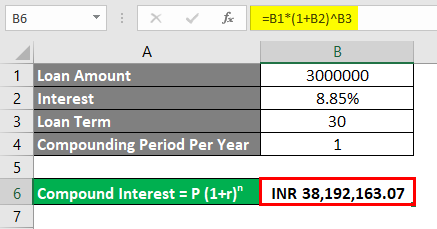

Calculate Compound Interest In Excel How To Calculate

Pros And Cons Of 15 Year Mortgages Buying First Home First Home Buyer Home Buying Tips

Pros And Cons Of Adjustable Rate Mortgages Adjustable Rate Mortgage First Time Home Buyers First Home Buyer

15 Mortgage Loan Calculators For Wordpress Wp Solver Mortgage Loan Calculator Mortgage Loans Mortgage Calculator

Fixed Vs Arm Mortgage Calculator Mls Mortgage Arm Mortgage Amortization Schedule Mortgage Amortization Calculator

Compare 30 Vs 15 Year Mortgage Calculator Mls Mortgage Mortgage Calculator Amortization Schedule Mortgage Rates

Mortgage Calculation With A Mortgage Comparison Calculator Mls Mortgage Mortgage Comparison Mortgage Loan Calculator Mortgage Estimator

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Calculate Compound Interest In Excel How To Calculate

15 Year Vs 30 Year Mortgage 30 Year Mortgage Mortgage Payment Mortgage Tips